By Every Family’s Got One Founder — Barbara Herel

Long before Suze Orman entered my financial world, there was my dad, Ronnie Herel, and his own method of achieving financial success affectionately known as – the Ronnie Herel Money Management System (RHMMS).

Here’s the RHMMS in action:

After gleefully ripping open my birthday cards as a kid, holding up a tidy sum of cash, checks, and the occasional savings bond (gee, thanks Grandma) in my hot little hands, Ronnie would always ask me…

“Babe, are you going to bank half of that?”

“Yes, Daddy,” I would reply in that exhausted-sounding singsongy way, feeling both mighty pleased and highly irritated. Pleased I was making a good choice yet irritated at him for reminding me to make it.

I guess the brainwashing paid off…

because by my early teens, I was firmly indoctrinated into the “Ronnie Herel Money Management System,” saving as much or more than I was spending.

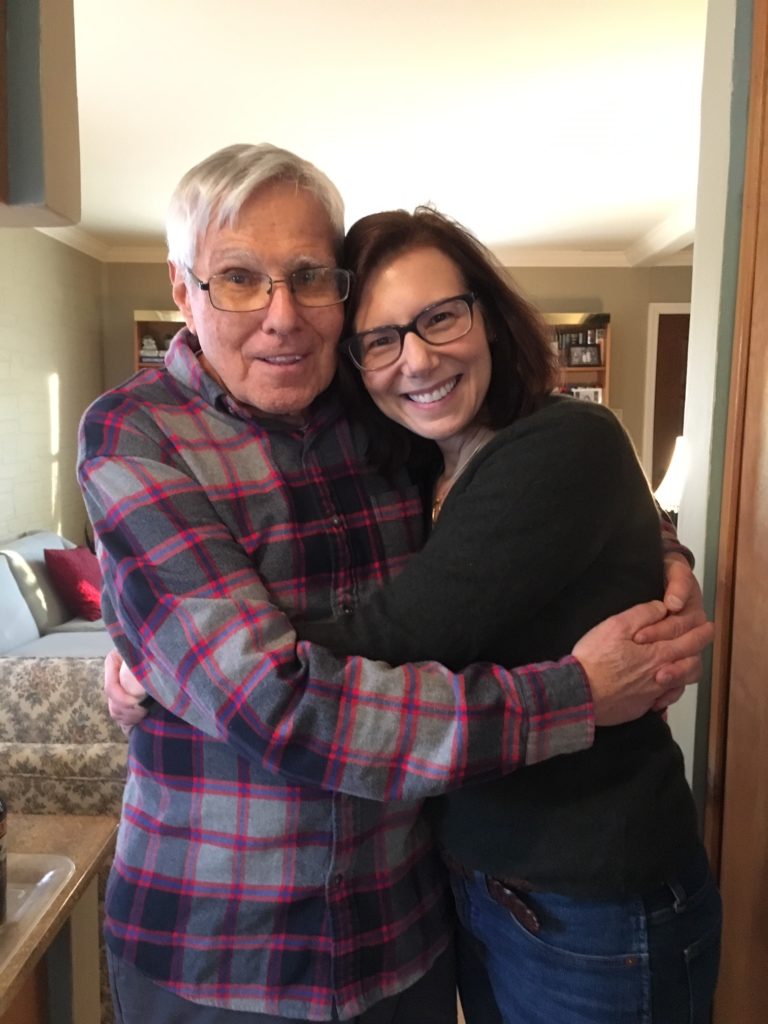

Father and Daughter

Family legend has it…

that by the age of 12, Ronnie had overheard too many late-night, family-finance arguments between his parents that he decided to earn his own money and began delivering papers. (Newspapers that is, remember them?)

When he was 15 he invested in his business by buying a bicycle and expanded his paper route to include another 25 houses. Soon Ronnie was earning $50 a week.

From that moment on…

he never took money from his parents. He paid for the movies, school lunches – he even saved up to buy his mother a rotisserie oven. (What kid wouldn’t want to do that?)

Ronnie’s financial contribution to the family was so deeply felt that his parents took out a life insurance policy on him. Which he still has as a matter of fact.

Now you’re probably thinking…

when this young entrepreneurial go-getter grew up he went on to start his own business, or ended up in some big senior management position – either way, living Top 1% wealthier ever after.

Well… no.

After serving in the navy…

Ronnie married my mom and took a job in the post office as a mailman, which he loved. He actually worked two jobs when they were first married to make ends meet.

They bought a house on Long Island and were worried about the monthly mortgage because it was $10 over what they had budgeted.

So why am I taking…

money lessons from a now-retired postal worker?

Because as a kid Ronnie had already tapped into the money secret that would bring him a lifetime of financial serenity – He had cultivated a deep respect for money.

Money…

like the ocean has a profound effect on our lives. It’s a powerful, intense, often mysterious relationship. Something many of us struggle to comprehend at one time or other.

I learned by my dad’s example that when you respect the power of money…

You take…

pride in paying your bills. And, believe it or not, come to enjoy paying your bills. On time, in full, every month.

You revel in watching your bank account grow. Yup. Whatever that minuscule, medium or large amount might be, you make a point to put it away and check back with later, much later.

And yes…

You love spending money on things you want. But you also find that you are super choosey on what you’re spending it on. What’s your “rotisserie oven” these days?

This is the kind of respect for money that brings financial peace of mind.

So, while…

he wasn’t the one I would seek out for answers to my teenage-girl problems, Ronnie could be counted on for giving the best hugs, playing a mean game of Ker Plunk, and helping me create a healthy life-long relationship with money.

The Ronnie Herel…

Money Management System is his legacy to me and my two brothers — and now, his grandkids. A legacy that no doubt will continue to enrich our family history for generations to come.

What’s your family legacy?

**********

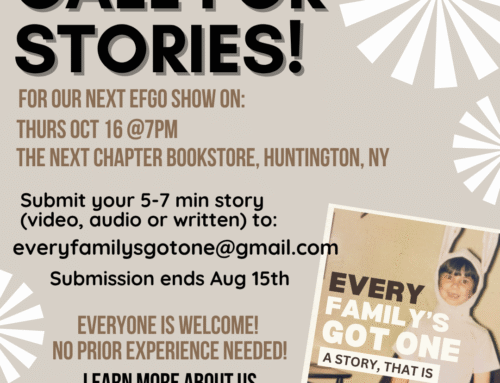

TELL YOUR FAMILY STORY!

Live On Stage! Details here!

Also, be sure to subscribe to our newsletter and “like” Every Family’s Got One on Facebook so you don’t miss out on important show updates.

Barbara I loved that story. It was funny and poignant. Your dad came alive to me. I can see him with his checkbook balancing it carefully. You draw a picture of a terrific dad. I am sure his influence went far beyond money matters.

Oh, thanks, Jackie! He’s a rich subject to write about for sure, haha. While this piece is more of a broad stroke, I can definitely get into the details in future Ronnie Herel stories (sorry Dad! Haha).

Your Dad is a very wise man. Love this story and looking forward to meeting you all!

He has his moments for sure, haha… Thank you, Merry, and same here.

Thanks for sharing! One of the best things a father could have instilled in his children. The fact that your father earned his own money and bought his mother the rotisserie oven says mountains about him as a man. I loved every word of your post. xoxox, Brenda

Oh Brenda, thanks so much for saying so! I love that the rotisserie oven his part of his legacy. xx

Oh, that is so awesome! My dad brings a whole new meaning to the word “cheap”. My mom, on the other hand, was a compulsive shopper. I’ve always been terrible with money.

I’m afraid my family’s legacy is guilt. Sorry to be a Debbie Downer.